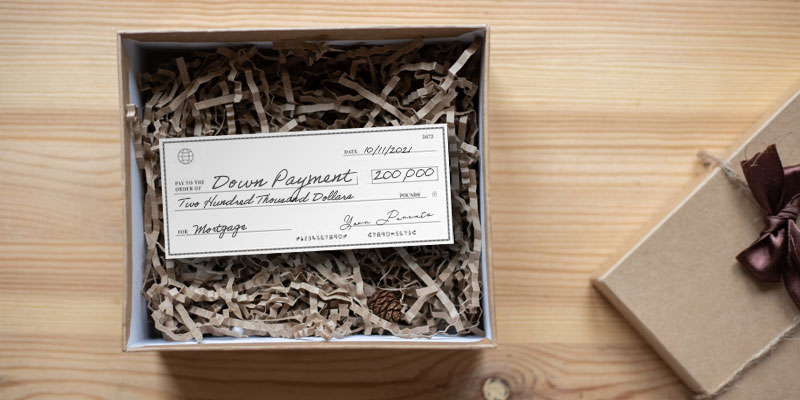

Saving up for a down payment is the number one obstacle faced by first-time homebuyers, especially as property sales prices continue rising. Did you know that your parents or other immediate family members can often “gift” money to you for use towards your down payment?

A gifted down payment isn’t considered a loan because it doesn’t have to be repaid. The person giving you the money will be required to provide a letter clearly stating that the money is a gift and not a loan. This helps alleviate risk as it demonstrates to the lender that the gifted money is, in fact, a gift and not something that needs to be considered an ongoing debt.

As more parents provide financial help to their children to buy a home, family law firms are seeing an increasing number of clients who are fighting with their kids over gifted down payments. That’s why lenders want proof upfront that this money is a gift in the true sense and the money doesn’t have to be repaid nor is interest being charged.

How much of a down payment is required?

The minimum down payment across Canada is 5% of the purchase price for a property valued at $500,000 or less and 10% for the portion of the purchase price above $500,000 regardless of whether you’re buying your first home or you’ve purchased multiple properties in the past.

Unless you have mortgage loan insurance, however, you must make a minimum 20% down payment. In order to qualify for mortgage default insurance, the down payment has to come from your own resources. One exception is if the down payment is gifted from an immediate relative. Not all lenders accept gifted down payments, and there are clear guidelines on who can provide the funds to you, but your mortgage agent will know which lenders offer this option and their rules.

Have questions about down payments or your mortgage in general? Answers to all your questions are a call or email away!