The Tribe Blog

10 Tips for Saving Your Down Payment on a Home

Saving for a down payment on a home can be challenging but, with careful planning and discipline, this important milestone will become much more easily achievable. Following are 10 helpful tips to get you started on your homeownership journey as soon as possible. 1....

Have You Thought About Buying a Place for Your Post-Secondary Children?

College and university residence spaces and local rental opportunities are tight in many areas with concentrated amounts of student population. That’s why it may be a great idea to consider buying a home for your child and their friends/roommates to live in while...

Signs to Look for to Help Prevent Mortgage Fraud

Mortgage fraud is a serious issue in Canada that is becoming extremely sophisticated, and can lead to significant financial loss and long-term complications for borrowers. To safeguard against this threat, as a potential homebuyer or mortgage borrower, there are...

How Does a Private Mortgage Compare to a Traditional Mortgage?

Private mortgage options have become increasingly more popular thanks to stringent stress test mortgage qualification rules required by traditional lenders such as banks, increased inflation and higher interest rates. It’s just one more option your mortgage agent can...

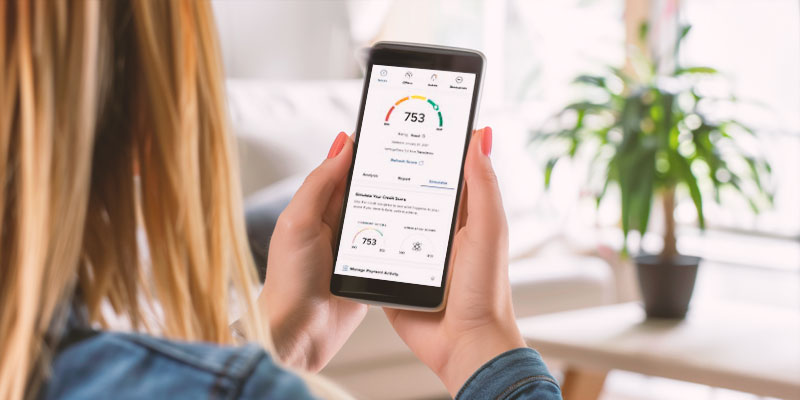

How to Increase Your Credit Score

When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities. Let’s face it, sometimes life...

Federal Budget Perks for First-Time Homebuyers & New Mortgage Fraud Measures

April 2024 has been an active month for news impacting mortgage borrowers! The 2024 federal budget contained some benefits for first-time homebuyers, which is a step in the right direction. In addition, the federal government announced big plans the mortgage industry...

Have You Taken Advantage of the First Home Savings Account?

Saving for a down payment is often one of the greatest barriers to homeownership. Fortunately, a First Home Savings Account (FHSA) encourages Canadians to intentionally plan ahead for your entrance into the housing market. First introduced by the federal government...

Calculating Your First-Time Homebuyer Budget

Buying your first home is extremely exciting, but it also takes a lot of planning, including building a realistic budget that helps ensure you can afford to carry all the expenses that come along with homeownership. Here are the key homebuying costs to include in your...

Have You Taken Advantage of the First Home Savings Account?

Saving for a down payment is often one of the greatest barriers to homeownership. Fortunately, a First Home Savings Account (FHSA) encourages Canadians to intentionally plan ahead for your entrance into the housing market. First introduced by the federal government...

Calculating Your First-Time Homebuyer Budget

Buying your first home is extremely exciting, but it also takes a lot of planning, including building a realistic budget that helps ensure you can afford to carry all the expenses that come along with homeownership. Here are the key homebuying costs to include in your...

An Annual Mortgage Review Can Maximize Your Savings

For many homeowners, securing a mortgage is a significant financial milestone. But, it’s just as important to regularly review and optimize that mortgage. This is where your mortgage agent becomes even more invaluable – proactively looking out for your best interests...

Planning Some Home Renovations? Ask Your Mortgage Agent About Financing!

Are you thinking of giving your home a makeover this year? Using your home equity may be the most economical financing solution to get the kitchen of your dreams or a spa bathroom retreat. And your mortgage agent can help guide you through this process. Home equity is...

How Does a Gifted Down Payment Work?

Owning a home is a major milestone for many Canadians, but the financial hurdle of coming up with a sufficient down payment can be a significant barrier. To address this, some aspiring homeowners turn to the concept of a gifted down payment – a strategy that can make...

Why it’s Important to Use a Mortgage Agent When Buying Your First Home

Becoming a first-time homebuyer is an exciting yet sometimes daunting experience, especially when navigating the complex world of mortgages on your own. Many first-time homebuyers find themselves overwhelmed by the pure volume of options available. Fortunately, your...

A New Year is a Fresh Start for Your Finances

For many Canadians, 2023 was a tough year thanks to high inflation and interest rates, and we’re ready to put it far behind us with the hope of a brighter year ahead. The good news is that economists are suggesting borrowing costs may have already peaked. After three...

Document Checklist to Prepare for Your Mortgage Application

Whether you’re becoming a homeowner for the first time or purchasing another property, this is an exciting time. But it also requires some work on your end in order to ensure the mortgage process runs as smoothly as possible. While it may appear as though you have to...

Tips for Navigating the Holidays on a Budget

In the spirit of the holidays, it’s easy to get caught up with the excitement of festive decorations, gift-giving, entertaining and gatherings with loved ones. But it’s important to stay on budget so you start 2024 off without financial regrets. Following are some...

November is Financial Literacy Month!

Your financial well-being is at the core of our mission as mortgage agents and brokers. And Financial Literacy Month is a great opportunity for you to get empowered and ensure you always make informed decisions regarding your mortgage and overall financial health....

How Can a Mortgage Refinance Help You?

There are numerous ways that you may be able to benefit from accessing some the equity built up in your home through a mortgage refinance, including helping cover the costs of the upcoming holiday season’s gift buying, decorating and entertaining. If your mortgage is...

Canadians Think Inflation is Even Higher Than Reality: BoC Survey

Results from a new Bank of Canada (BoC) survey show that Canadian consumers believe inflation is higher than it actually is, and they expect it to remain high despite data showing that it’s actually on the way down. The BoC released the results of its survey of...

Haven’t quite found what you are looking for?

No worries, try searching our archives.