When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities.

Let’s face it, sometimes life happens and your credit takes a hit due to missed or late payments, high debt levels, etc. Fortunately, your mortgage agent knows the ins and outs on how to help repair your credit. The key is to start right away. The longer you leave it, the worse your credit situation will become.

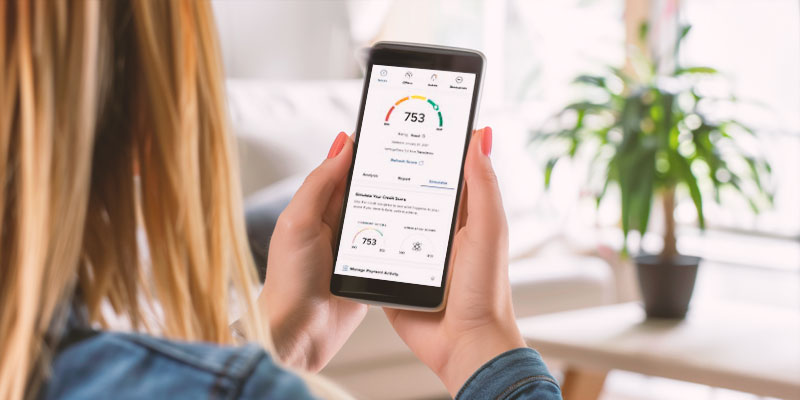

Your credit history is compiled into a credit report, which then provides an overall summary of your financial history to lenders. Canada’s two credit reporting agencies – Equifax and TransUnion – use the information in your credit report to establish a credit score, which is presented as a three-digit number. As a point of reference, the average credit score is in the mid-700s and a perfect score is 900. The lower your credit score, the harder is it to obtain a mortgage at a competitive rate.

Your mortgage agent has in-depth knowledge of credit scoring systems and lending criteria. They’ll begin by reviewing your credit report to identify areas that need improvement. By pinpointing issues such as late payments, high credit utilization or errors on your report, your agent can provide tailored advice to effectively address these problems.

Tips for improving your credit

Some credit situations take longer to repair than others, but here are some quick tips to help get you on the road to healthier credit right away:

1. Ensure you’re living within your means by creating a budgeting and sticking to it.

2. Always make at least the minimum payment on your loans.

3. Make payments on time.

4. Keep your balances low.

5. Consolidate debt to lower interest rates (ask us how!)

6. Apply for new credit accounts only when necessary.

Improving your credit score isn’t a one-time task, but more of a continuous process. Your mortgage agent can provide ongoing support, regularly reviewing your progress and adjusting the strategy as needed. This proactive approach ensures that you’ll stay on track to achieve and maintain a higher credit score.

Have questions about your creditworthiness? Answers are a call or email away!