by Tribe Financial | Jun 21, 2024 | Blog, Homeownership

Mortgage fraud is a serious issue in Canada that is becoming extremely sophisticated, and can lead to significant financial loss and long-term complications for borrowers. To safeguard against this threat, as a potential homebuyer or mortgage borrower, there are...

by Tribe Financial | Jun 7, 2024 | Blog, Finance, Homeownership

Private mortgage options have become increasingly more popular thanks to stringent stress test mortgage qualification rules required by traditional lenders such as banks, increased inflation and higher interest rates. It’s just one more option your mortgage agent can...

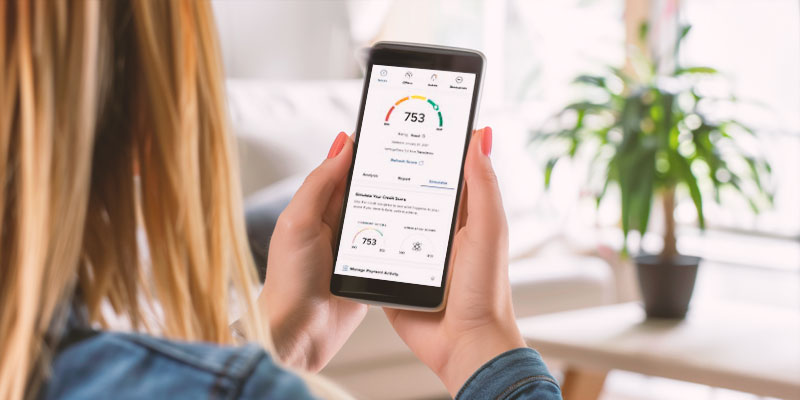

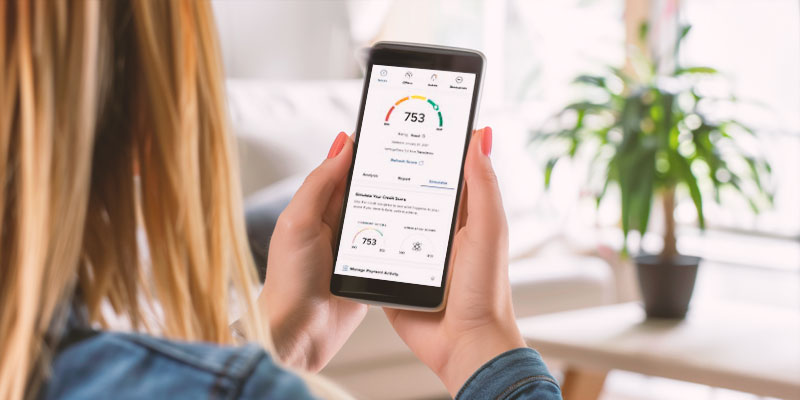

by Tribe Financial | May 17, 2024 | Blog, Finance

When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities. Let’s face it, sometimes life...

by Tribe Financial | May 3, 2024 | Blog, Economy

Real estate has proven to be a sound long-term investment. If you’re thinking about buying an investment property, consulting with your trusted mortgage agent is a terrific place to start. Your agent can play a crucial role by providing valuable expertise throughout...

by Tribe Financial | Apr 19, 2024 | Blog, Homeownership

April 2024 has been an active month for news impacting mortgage borrowers! The 2024 federal budget contained some benefits for first-time homebuyers, which is a step in the right direction. In addition, the federal government announced big plans the mortgage industry...